While the past few years have seen brick-and-mortar retailers embrace big-box stores with large footprints, a recent study from placer.ai found that smaller stores come with their own set of benefits. A growing number of tenants are experimenting with reduced footprints in a variety of ways.

The obvious benefit to smaller-format stores is reduction in space costs, depending on location, and it gives retailers a chance to enter more dense, expensive urban locations that otherwise wouldn’t support a big-box format. Yet these shops also allow retailers to target specific sets of customers, create a personalized shopping experience or experiment with new brand concepts. They can also serve as return hubs and fulfillment centers for buy-online-pickup-in-store

Researchers at Placer Labs, Inc. studied how smaller stores have been working out for four of the nation’s major retailers who’ve adopted the concept. They’ve found that this format has not only been received well and provided growth for the brands, but also aligns with the retailers’ objectives for their existing, larger-format locations.

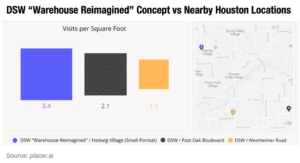

Earlier this year, discount footwear retailer DSW Shoe Warehouse introduced a new small-format store at the Hedwig Village shopping center in Houston. At about 15,000 square feet, “Warehouse Reimagined” was just under two-thirds the size of a traditional DSW store. By using space more efficiently and increasing customer density, the new format store was able to attract many more visitors per square foot than two regular DSW stores nearby—at a rate of 3.4 visits per square foot versus 2.1 and 1.1 visits per foot. Customers got a reimagined shopping experience while DSW reduced its overhead costs.

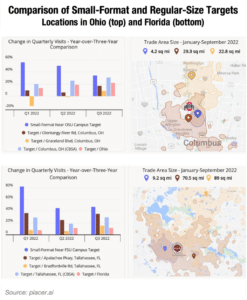

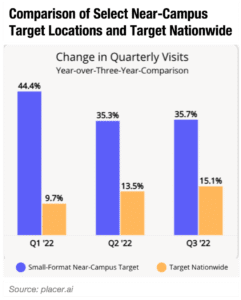

Known for its big-box locations averaging around 130,000 square feet, Target has been rolling out small-format stores of 15,000 to 40,000 square feet for the past decade. About 25 of those stores are located on or near college campuses and cater specifically to students—that is, primarily stocking products a college student would buy, such as toiletries, school supplies, quick-prep meals (ramen, anyone?), dorm room supplies and the like. For bigger items, students can buy online and pick up at their campus Target.

By targeting a specific demographic—rather than trying to appeal to a larger swath of the population, Target can avoid cannibalizing itself with multiple locations within overlapping trade areas. These stores provide a more efficient and convenient experience for their target customer base since they won’t have to travel off campus for necessities. A younger cohort of customers (campus stores’ shoppers are on average six years younger than customers at regular stores) also away from its traditional grocery stores.

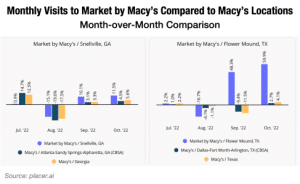

While Publix is trying to keep customers in GreenWise stores longer, Macy’s launched a small-format concept in 2020 designed to maximize speed and convenience. Part of the department store’s larger restructuring strategy, Market by Macy’s carries a curated selection of merchandise in stores specifically designed with ease-of-navigation in mind.

The retailer is planning to open its eighth Market by Macy’s location by the end of 2022. When comparing these smaller concepts to conventional Macy’s stores within the same area, Market by Macy’s saw significantly higher levels of foot traffic and much lower dwell times than their larger brethren—which is the point given its focus on “quick and easy” shopping. Further, researchers found that a more streamlined shopping experience attracts a financially stable and loyal customer base that might not otherwise shop at traditional department stores.